Kentucky tax preparer refuses to file taxes for married same-sex couples, bragging his actions are legal

Ken Randall can refuse service to gay couples because of a lack of statewide and local nondiscrimination laws.

A Kentucky tax preparer is boasting that the lack of a statewide nondiscrimination law entitles him to refuse to file joint tax returns for same-sex married couples.

Ken Randall, a registered tax return preparer and insurance broker who owns two businesses, including Aries Tax Service, in Radcliff, Kentucky, has posted a sign in the window of his tax preparation business stating his intention to discriminate.

In the sign, Randall claims anyone can file returns for $55 as long as they provide nine types of documents, forms, or other pieces of information to him. But following those nine criteria, Randall has added a tenth clause to the sign, which states: “Homosexual marriage not recognized.”

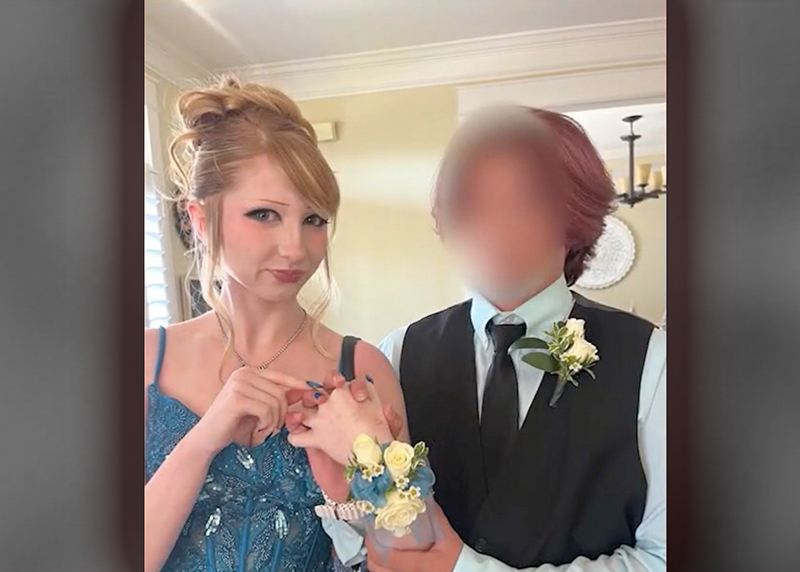

On April 3, the sign was noticed by Amy Mudd of Glasgow, Kentucky, and her wife, Stephanie, who had been referred to the business by Stephanie’s mother, a Hardin County resident who had seen signs touting the relatively cheap filing fee of $55.

Mudd had previously set up an appointment with Randall via phone. But after driving for over an hour to reach Aries Tax Service, Mudd and her wife refused to enter after seeing the sign posted in the window.

“We are NOT doing any business here,” Stephanie said, according to Mudd. Instead, the couple ended up going to their regular tax preparer in Brandenburg, Kentucky.

“We have a wonderful family, and to be shamed because of who I love is awful,” Mudd, the mother of twin daughters, told The Courier-Journal in an email. “It’s 2021, and I’ve never understood why discrimination is a thing. Black, Asian, Muslim, LGBTQ+, etc. We are all human.”

Randall told The Courier-Journal he has “moral objections to homosexual marriage.”

“I have filed and do file for homosexuals who are single, as I do not ask about sexual preference prior to filing a return,” Randall said. He added: “This is legal, as I have already researched this.”

See also: Indiana lesbian couple turned away by tax preparer because they’re married

Because neither the town of Radcliff nor Hardin County have Fairness Ordinances that prohibit discrimination against LGBTQ people, Randall is perfectly within his right to refuse to do business with same-sex marriage couples.

Currently, only 21 municipalities or counties in Kentucky have Fairness Ordinances, and repeated attempts to pass an LGBTQ nondiscrimination bill have failed in the Kentucky General Assembly, both under Democrats and under Republicans, who currently hold supermajorities within the House and Senate.

Chris Hartman, the executive director of the Fairness Campaign, confirmed that Randall can legally deny services to same-sex couples due to the lack of statewide and local protections.

He told The Courier-Journal that while a Supreme Court decision from last year protects LGBTQ employees from workplace discrimination, the scope of that protection is limited, and does not extend to places of public accommodation, like a tax preparer’s business. The only exception, under state law, would be if Randall’s business was “supported directly or indirectly by government funds.”

Randall’s refusal to file taxes for same-sex couples echoes the story of a tax preparer in Russiaville, Indiana, who made national headlines in 2019 after she turned away a lesbian couple based on her personal religious beliefs opposing homosexuality and same-sex marriage.

She claimed she was protected by the state’s 2015 Religious Freedom Restoration Act, which allowed business owners to refuse services to people if doing so would violate their religious beliefs.

But Hartman said, regardless of whether he’s legally entitled to refuse service, Randall’s sign is “rude.”

“It’s discriminatory. It’s disgraceful,” Hartman said. “And it’s a downright shame.”

Read more:

Trans woman files for emergency injunction to stop Georgia prison officials’ retaliation against her

Caitlyn Jenner considering running for California governor in recall election

Tennessee House passes “Business Bathroom Bill” in effort to shame trans-friendly businesses

Support Metro Weekly’s Journalism

These are challenging times for news organizations. And yet it’s crucial we stay active and provide vital resources and information to both our local readers and the world. So won’t you please take a moment and consider supporting Metro Weekly with a membership? For as little as $5 a month, you can help ensure Metro Weekly magazine and MetroWeekly.com remain free, viable resources as we provide the best, most diverse, culturally-resonant LGBTQ coverage in both the D.C. region and around the world. Memberships come with exclusive perks and discounts, your own personal digital delivery of each week’s magazine (and an archive), access to our Member's Lounge when it launches this fall, and exclusive members-only items like Metro Weekly Membership Mugs and Tote Bags! Check out all our membership levels here and please join us today!

You must be logged in to post a comment.